Inflated building replacement values cost lot owners thousands of dollars in excess premiums and can cost body corporate managers their contracts. The only protection against premium gouging is regular valuations by an independent expert.

What is premium gouging?

Premium gouging is the term used to describe setting annual increases to the Building Sum Insured (BSI) that grossly exceed the actual rate of inflation in the building industry.

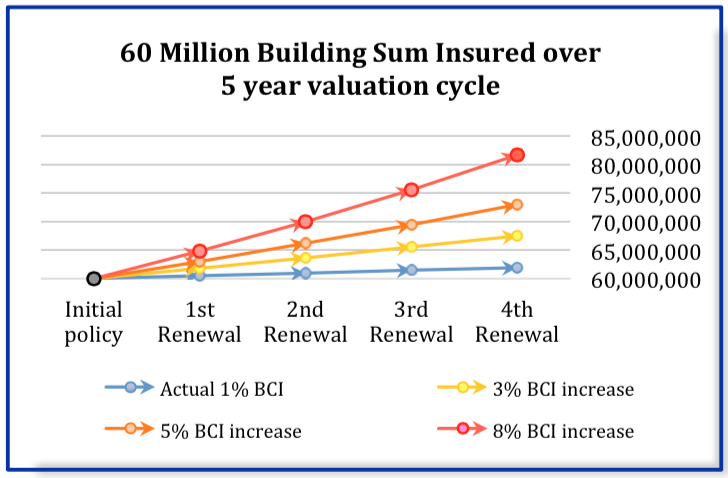

It is well known that underwriters associated with the strata insurance industry frequently automatically increase the Building Sum Insured (BIS) by as much as 5% – 8% annually. By comparison, the total increase in Queensland construction costs over the past five years has been a mere 4% or an average of 1% per annum.1 Similar rates of inflationary increase have occurred in other states.

In Queensland, NSW and Victoria, the strata legislation only requires a strata scheme to review its BSI every 5 years – leaving 4 years of compound underwriter increases. To give this scenario a sense of proportion, you need only apply the tried and tested rule of 72.

Using this mathematical rule, we can calculate that over the four years of underwriter increases, an 8% annual increase will have increased the initial BSI by approximately 36%. While at the same time, the actual increase in building industry costs over the past four years was only approximately 4% – a difference of a whopping 32%! This is more than nine times the actual percentage increase. Is it any wonder that it is called premium gouging?

How does premium gouging occur?

You could be forgiven for thinking that the underwriting industry is deliberately ripping off unit owners by recommending annual BSI rate increases that are more influenced by the desire for corporate profit than actual cost statistics.

We suspect the problem is more complex than that and starts at the beginning of the renewal process.

Underwriters have to determine at the end of the first year cover what the rate of increase should be for the subsequent 12 months – assuming the insured party does not provide a new valuation.

The insurance industry, being conservative by nature, looks at inflation trends in the building industry over a long period of time and then adds a bit for safety’s sake. (We should point out here that there have been periods of high inflation in the building industry, although not in recent times.) At the next renewal, rather than review the insured sum to take into account the actual inflation rate for the previous twelve months, underwriters tend to let the automatic adjustment process roll on.

What are the consequences?

Charging unit owners for building insurance based on inflated valuations is not a good look for the industry.

Underwriters may well claim that the insured always has the option to seek an independent valuation at their cost – rather than accept the automatic increases built into the policy. And they are correct. The problem is that the legislation requires a valuation to be carried out only once every five years and most strata schemes, at the advice of their managers, wait the full five years.

The consequences of premium gouging can be severe. It is rumored that in recent times, a Queensland body corporate has taken legal action against an insurance broker for premium gouging and won a five-figure settlement. There are more actions underway.

It is self-evident that if a manager does not make its clients aware of the financial cost of premium gouging, it will lose the trust of the unit owners and will probably lose the management contract as a result.

The Unit Owners Association of Queensland is actively educating bodies corporate regarding this matter. It is only a matter of time before your strata committees will be aware of the hidden costs of premium gouging.

What can be done to solve the problem?

You might suggest that the underwriters change their habits and adopt a policy of reviewing the actual rise in inflation at the end of each twelve-month period. Because of the complex relationship between the underwriters and their brokers We doubt this will ever occur.

What is required is an independent and appropriately qualified service provider to provide an accurate estimate of the cost to replace the building.

The optimum frequency for obtaining that independent valuation depends on the scheme.

If you graph BSI and premium costs for a range of strata schemes, you discover that the relationship between the BSI and the premium cost is not constant. Typically, small schemes pay a higher amount per dollar of BSI. As schemes get larger (and their premium passes a critical point) the cost per dollar of extra BSI decreases. In addition, property specific factors such as location, disaster exposure, use and claims history will vary the premium charged.

The optimum frequency for obtaining an independent replacement valuation can be calculated using the formula:

Optimum frequency = (initial BSI x BSI inaccuracy† / price per dollar of BSI) / Cost of valuation

↑ with BSI inaccuracy being the difference between the automatic increase and the actual building cost increase

For example, if a scheme with an initial BSI of $60 million in 2013 was reinsured in 2014 with a 3% BSI increase at a typical price of $1,000 per million dollars of BSI, the excess premium paid would have been $1,200. Our typical fee for updating the building replacement valuation would have saved over half this amount. Multiply that first year’s saving by four and even at this low rate of underwriter adjustment the savings become substantial.

Based on Leary & Partner’s update fee, we suggest the break-even point for annual valuations starts at around a BSI of $15 million. For schemes with a BSI of over $40 million, annual valuations should be an automatic requirement. As the BSI drops below $15 million, a frequency of 2 or 3 years may be appropriate. Only for schemes with a minimal value of common property being insured would we recommend the maximum 5-year valuation cycle.

Any other tips for ensuring a fair premium?

In additional to obtaining frequent independent valuations, these two tips can also help ensure that the lot owners pay a fair premium to insure the building.

1. Avoid biasing the valuation

Unfortunately, many strata managers are in the habit of advising their valuation service provider of the current BSI. Service providers are aware that strata managers generally receive a commission based on the sum insured and consequently some are reluctant to provide an honest valuation. Providing current BSI information to valuation service providers is a self defeating exercise, unless your aim is to maintain the status quo.

2. Use the right consultant

Like all professional skills, accurate valuations require professional training and real world experience. As the ATO officially recognises 2, appropriately experienced quantity surveyors are the go-to professionals for reliable construction cost estimates.

1 Rawlisons Australian Construction Handbook’s Building Price Index for Brisbane 31/3/2011 and 31/3/2015.

2 ATO Ruling TR97/25 for Division 43 construction cost calculations