Taxation Depreciation

Schedules

10 good reasons for choosing Leary & Partners

- Our Tax Partner Kaylene Arkcoll (Masters Appl. Law – Taxation) will personally ensure the appropriateness and accuracy of your claim.

- All our reports are prepared by degree qualified quantity surveyors

- All our reports are ATO compliant

- Competitive price guarantee

- Zero commissions paid

- We guarantee every schedule will result in a viable claim

- Our fees are 100% tax deductible

- Our report will ensure you maximise your return on investment

- We have prepared more than thirty thousand schedules for residential, commercial & industrial properties

- Free telephone consultation to ensure your property qualifies for a claim

It is no idle claim to say the name Leary and Partners has become synonymous with the preparation of taxation depreciation schedules for strata title buildings. However, we also do schedules for other types of property – from retirement villages and major industrial complexes to farm sheds and large retail shopping centres.

Most large accountancy firms and many small and medium sized firms throughout Australia have clients who have received schedules prepared by Leary & Partners.

Company associate, Ms Kaylene Arkcoll, heads the taxation consulting division. Kaylene is a registered tax agent who holds a Master of Applied Law (Taxation Law). She specialises in property tax related research and is responsible for the company’s information support services.

View our sample reports

I Own a Property, Can I Claim a Tax Deduction?

To qualify for a tax deduction your property needs to be income producing.

This normally means the property must either be rented or used as the setting for your business. Almost all properties that meet this requirement will be eligible for some form of depreciable claim. The important questions are “What type of claim am I making?” and “How much can I claim?”.

There are two types of ‘depreciation’ deductions that may apply to your property. Both types of deduction have their own special qualification requirements and calculation methods.

Deduction Type 1: Division 43 Building Allowance

The Division 43 building allowance is an annual deduction based on a set percentage of the building’s original construction cost. The percentage varies between 2.5% and 4.0% depending on when construction commenced and for what the building is used.

Residential Properties

If construction of your residential property commenced after 15 September 1987 it will qualify for the Division 43 construction allowance.

(For residential properties commenced between 18 July 1985 and 14 September 1987 the deduction rate was 4%. However this deduction had a 25 year life from when the property was first used. The Division 43 deduction on these properties has usually either finished or is very close to finishing.)

Commercial Properties (any property not used for residential purposes)

If construction of your commercial property commenced after 19th July 1982, it will qualify for the Division 43 construction allowance.

(For commercial properties commenced between 22 August 1984 and 15 September 1987 the deduction rate was 4%. However this deduction had a 25 year life from when the property was first used. The Division 43 deduction on these properties is no longer available.)

Structural Improvements to Land

Originally, Division 43 deductions were limited to structures that would generically be described as ‘buildings’. Since 27 February 1992 you can also claim a deduction for built structures such as roads, driveways, paths, retaining walls, fences, swimming pools, clothes lines, etc. (but not for soft landscaping such as gardens and lawns).

Alterations or Additions to the Original Building

Structural changes or additions to a building after it was constructed are treated as “mini-building projects” and qualify for the Division 43 deduction based on the rate and cost at the time they were done. This means that there may be a smaller Division 43 deduction for your property even if the original construction is too old to qualify. Typical “mini-building projects” include adding a deck, patio or carport, refurbishing bathrooms, replacing kitchen cupboards, tiling floors or adding security screens.

At certain periods of time, higher Division 43 rates have applied to specialist categories of building (such as short-term traveller accommodation and manufacturing buildings). Special qualification requirements mean these deductions are not available to most taxpayers.

Deduction type 2: Division 40 Depreciation

The Division 40 depreciation system is basically the same for residential and commercial properties, although different items may be eligible for depreciation and the depreciation rates may vary.

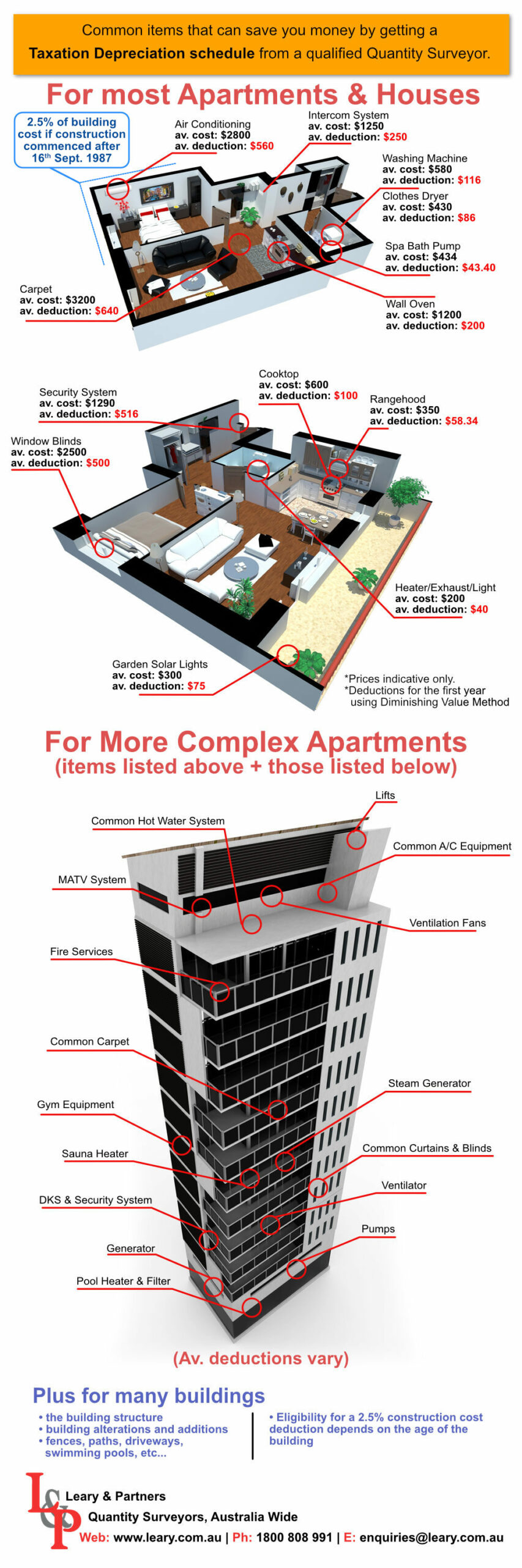

In a simple residential property, Division 40 deductions can be claimed on items such as: carpet, cooktops, wall ovens, dishwashers, rangehoods, hot water units, air conditioning units, smoke detectors and curtains and blinds. Each property needs to be individually checked to identify all its eligible items.

You will qualify for a Division 40 depreciation claim on these items regardless of how old the building is or how previous owners used the property. This means that there will be a Division 40 claim for most properties.

Because the Division 40 deduction associated with a property depends on the number, type and condition of the depreciable items, the claim available to you can vary substantially between otherwise similar properties.

For example, a four-year-old house with extensive carpeting and air conditioning may have a higher claim than a house that has just been refurbished with polished timber floors and no air conditioning. Conversely, if the items in the first house are eight or nine years old, this will be reflected in their market value and result in a comparatively low value claim.

If your property does not qualify for a Division 43 deduction and you are not sure whether the Division 40 furniture and equipment will justify commissioning a depreciation schedule, call us and ask.

Want to know more about making a claim?

2017 Budget update

The government has announced major changes affecting depreciation for residential properties purchased after 7:30pm AEST 9th May 2017. The treasury Law Amendment (Housing Tax Integrity) Bill 2017 is currently being debated in Parliament. We will update our website once the Bill has been passed and the final details are known.

If you purchased your property after this date please phone us on 1800 808 991 talk to our senior tax agent for the latest advice. If you purchased your property prior to 9th May 2017, you will not be effected by the changes.

for more information see:

• 2017 Budget negative impact for property owners

• Residential Depreciation Changes: More Uncertainty for Investors